At the Fazenda do Haras Larissa, the mood among the well-heeled crowd is tense with anticipation.

The vast luxury rural development in the hills near São Paulo, which has a rural English theme that includes imported 18th century carriages complete with liveried drivers, is due to host a polo match led by Britain’s Prince Harry.

When the prince finally lands on the helicopter pad, which has space for 30 choppers, he presents the only genuinely English moment of the day when he is self-deprecating about his chances of winning the polo match.

“I’m a bit rusty,” he tells the gathered elite.

While the event was for charity, business is never far away in the new Brazil. In a country that produced 22 millionaires a day in 2010, Haras Larissa, whose most expensive plot sells for R$16m ($8.5m), is just another attempt to profit from the astonishing wealth created by a decade of economic growth in Brazil.

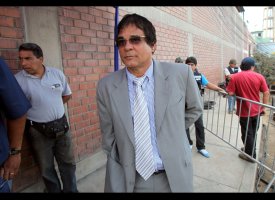

“The luxury property market is booming because Brazil is booming,” says the developer, Alvaro Coelho da Fonseca, one of Brazil’s richest real estate barons.

International attention over the past decade has focused on the

rise of Brazil’s lower middle-class, who earn between R$1734 and R$7,475 per household a month and have turned the country into one of the world’s most promising consumer goods markets. But while this group accounts for more than half the population, it is the so-called B and A classes – those earning more than R$7,475 – that are poised to grow fastest in the coming years, analysts say.

More

ON THIS STORY

ON THIS TOPIC

IN AMERICAS SOCIETY

Unlike China and India, Brazil’s growth story has been more about income redistribution than rapid expansion of gross domestic product. This has led to a ballooning of the lower middle class by nearly 60 per cent between 2003 and 2011, according to Professor Marcelo Côrtes Neri of the Getulio Vargas Foundation, an academic institution. Their numbers are set to grow another 12 per cent by 2014.

But more impressive will be the growth of the A and B classes. The ranks of those people with incomes more comparable to those of the middle and upper classes of advanced economies are expected to more than double by 2014, compared with 2003, to more than 29m, a population nearing the size of Canada.

The rise of the well-educated and financially empowered groups is changing Brazil’s political and social fabric, analysts say, in the form of greater demands for efficient government.

“There is a political tsunami coming in Brazil,” says Chris Garman, analyst with Eurasia Group, the consultants.

Brazil’s president, Dilma Rousseff, enjoyed a record approval rating of 77 per cent in mid-March despite

economic growth slowing last year. She was helped by low unemployment and salary increases.

But her government knows that a more prosperous population means a more exacting electorate. Analysts say it is partly for this reason that she has shown

less tolerance of corrupt ministers than in the past, dismissing a swath of them last year.

“She is going to increasingly be held accountable on the quality of public services and no longer just on growth and income,” says Mr Garman.

Multinationals and domestic businesses, meanwhile, have also taken notice.

BMW, Mercedes,

Volkswagen and other car manufacturers are targeting Brazilwith higher end models. Chivas Brothers, the owner of the Chivas Regal whisky brand, says Brazil’s booming north-eastern city of Recife has the highest per capita whisky consumption in the world.

“When we look at the world … Brazil is one of the top three opportunities,” says Christian Porta, chief executive of the company and one of the sponsors of Prince Harry’s polo match last month.

Financial services such as private banking are booming. There was R$434.4bn under management in the country’s private banking sector in December, according to industry data, an increase of 21.6 per cent from the previous year.

“We’re now seeing a second generation of wealthy families with this new economic phase of the country,” says Silas Caldana, the director of Oslo Patrimômio, which manages family fortunes in the southern state of Rio Grande do Sul. His company, which caters to clients with more than R$50m, expects to double its number of clients in the next two years.

Local entrepreneurs, such as Mr Coelho da Fonseca, are also determined not to miss the boat. His development also has 700 sheep to give its tenants the feeling of being in Oxfordshire rather than subtropical São Paulo. It also has a test drive circuit for Range Rover.

“The whole thing was inspired by the English countryside – you know, roads that don’t have tarmac,” he explains, adding that he also keeps a residence on the development. “My house is also a type of English cabin. But it’s very small – only 400 square metres [4,305 sq ft].”